As the post-pandemic world begins to shape up, the patent litigation world has seen billion dollar verdicts to record-breaking amounts of litigation financing. The explosive growth in litigation financing has come from a backlog of capital during the covid pandemic and investors seeking non-cyclical returns. As highlighted from last year’s report on NPE patent financing in the Western District of Texas, this trend can be seen among the top-5 patent venues. From Waco to Silicon Valley to Delaware, the effect of aggregations and financing can be seen.

These venues were chosen, since the Western District of Texas now accounts for 25% of all patent litigation, while the remaining four account for 43% in the first quarter of 2021. Collectively, these five venues have seen the most litigation over the last five years, with nearly 70%.

As identified last year the rise, anecdotally, seemed tied to frequent filers, co-owned entities, and entities underwritten by private litigation financing. Unified examined public databases, such as Edgar, to determine if there was an aggregator and known financing. NPE aggregators were defined as NPEs that have more than one affiliated subsidiary also bringing patent litigation. Third-party financing was defined as any third party with a financial interest, other than the assertors.

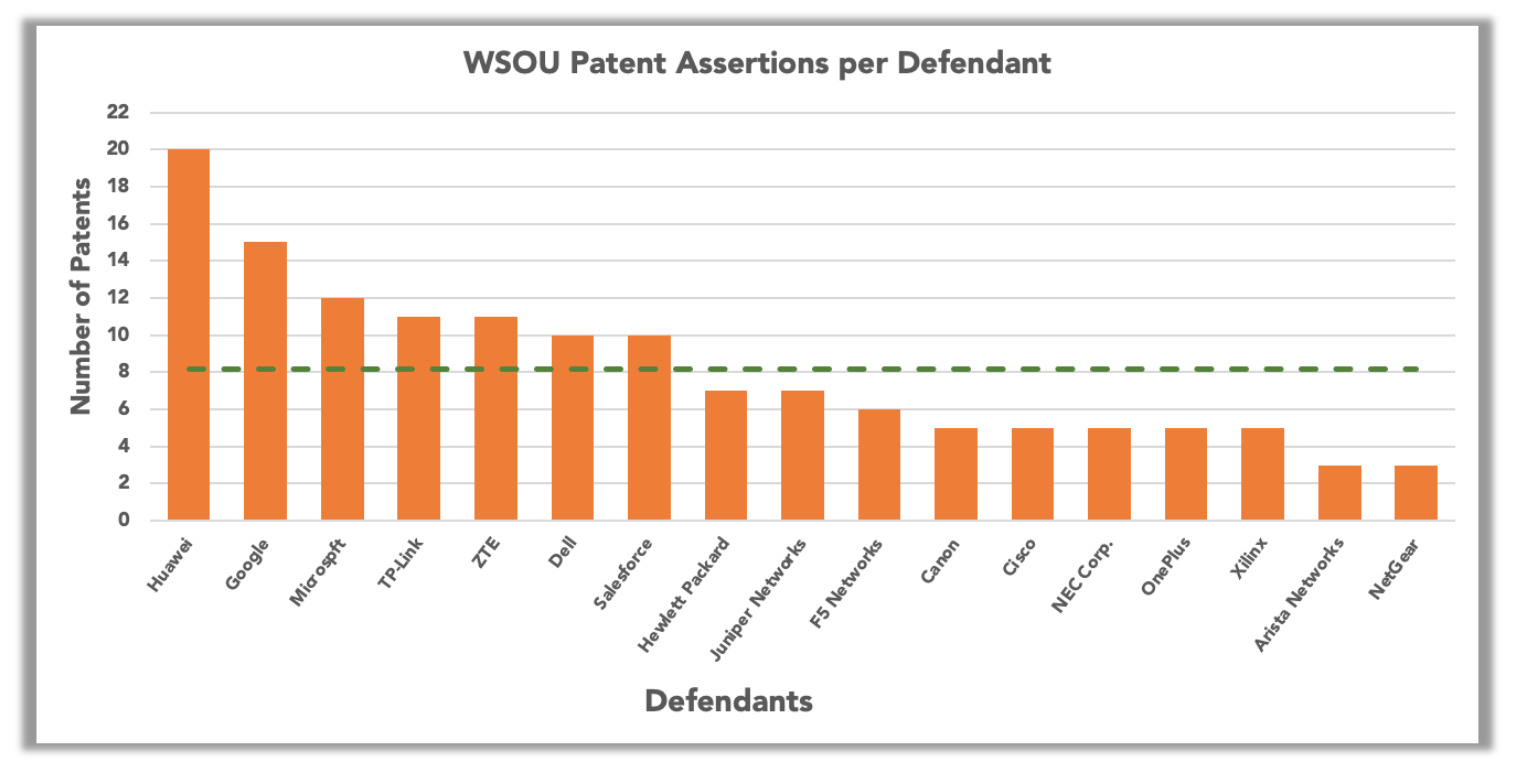

When looking at the new rocket docket, the Western District of Texas, the momentum has not stopped. Nearly 64% of all cases can be attributed to patent aggregators---i.e., entities like WSOU or Uniloc.

The year-by-year data would suggest that this momentum is only growing. The Western District of Texas–-fueled almost entirely by the Waco division–-has already seen 172 of it's cases linked to an aggregator, of the 333 cases brought in 2021 to date.

In addition, nearly 50% of all of the cases brought in the Western District of Texas can be tied to litigation financing.

Judge Albright has made the Western District of Texas not only a safe haven for small-time NPEs, but also one for those investors who are looking to use US patent litigation to reap non-cyclical, non-correlated returns.

And although the Eastern District of Texas has seen a dramatic decrease in cases, 90% of cases it has seen can be attributed to aggregators.

This trend of decreasing caseload increasingly dominated by patent aggregators can be seen below.

And with the aggregation effect comes financing, with nearly 63% of all cases being financed.

The yearly trend can be seen below.

New to this year's report, but has a long tradition in litigation, is Delaware. Interestingly, between 2015 and 2021, over 62% of all patent cases can be attributed to an aggregator.

The yearly breakdown of this trend can be seen below.

The financing identified attributes to nearly 30% of all aggregators.

While litigation may also be declining in Delaware, litigation-financed suits over the last couple of years have picked up steam.

California Northern has also seen a rise in aggregation, with nearly 57% of filed cases associated with aggregators.

Looking at the year-by-year trends, aggregation in this district appears to remain steady.

Around 16% of all aggregation has some form of financing.

Last year, despite the pandemic, financing found its way into the most cases ever recorded.

California Central has seen nearly 50% of all cases can be attributed to an aggregator.

The year-by-year breakdown can be seen below.

While not as prominent, financing can be attributed to over 13% of all cases.

There has been some movement in recent years regarding financing in California Central.

Obviously, financing and third-party economic backing is shrouded in secrecy, so this data necessarily underestimates the total percentage of cases funded by third parties, whether through private capital groups like Magnetar, Starboard, Vector Capital, or Burford Capital, or via private sources unwilling or unable to acknowledge their stake. But what is clear from an honest assessment of filed cases is that in all of these top venues, more than 50% of patent litigation is related to patent aggregators.

Copyright © 2021, Unified Patents, LLC. All rights reserved.